Rewriting the Rules: What CCA Reform Must Get Right

Read Time 5 mins | Written by: Ewan Willars

Amplifi's perspective on the proposed overhaul of the Consumer Credit Act

The Consumer Credit Act (CCA) has been in existence, largely unchanged, since 1974. During this time, the way consumers access credit and the way firms communicate with them in other areas has changed beyond recognition. In July 2025, HM Treasury launched Phase 1 of its CCA Reform Consultation, outlining plans to replace outdated provisions and rework them into the FCA’s Handbook, and move to a more outcomes-based, less prescriptive framework.

Amplified Global has submitted a formal response to HM treasury's review of the CCA, drawing on our regulatory research, platform insights, and multi-year collaboration with the FCA.

From our perspective, the proposed reform offers a real opportunity, but only if three priorities are addressed:

1. Compliance Isn’t the Same as Clarity

Today’s disclosures often meet technical and legal requirements but often fail to deliver consumer understanding. Information is legally compliant, yet often poorly understood, and that gap presents a risk for firms and consumers alike.

If the new rules are to succeed, they must go beyond simplification and support intelligibility. This would mean ensuring consumers understand not just the words but the meaning, consequences, and context.

2. Reworking the Rules: Purpose Over Prescription, Not Overreach

We support the proposal to replace prescriptive information rules from the CCA and rework them with FCA rules. That shift will allow for clearer, more digitally aligned communication and reduce the convenient excuse that “'if it’s compliant, it doesn’t need to be clearer.’”

However, some degree of standardisation will still be needed. A fully flexible approach without safeguards could:

- Undermine comparability across products

- Place an expensive burden on smaller firms without design or testing resources

- Allow poor practices to persist in the absence of meaningful enforcement

3. Make Intelligibility Measurable and Mandatory

The reshaping of the CCA reflects a broader regulatory shift: box-ticking isn’t enough, firms must now prove that their communications lead to real understanding. That requires clear expectations around how to test, evidence, and improve consumer-facing information, and to have mechanisms for the FCA to step in when firms fail to meet expectations.

We believe intelligibility should be treated as a core compliance standard supported by:

- Clarity on what good looks like

- Practical guidance on testing methods (e.g. comprehension testing)

- Requirements to report on communication outcomes

- A visible enforcement for firms that consistently fall short

Without this, the root problem will remain. Much of what consumers are asked to agree to is still hard to understand and, without change, that will simply be repackaged under a new regime.

The Intelligibility Gap is Still Wide

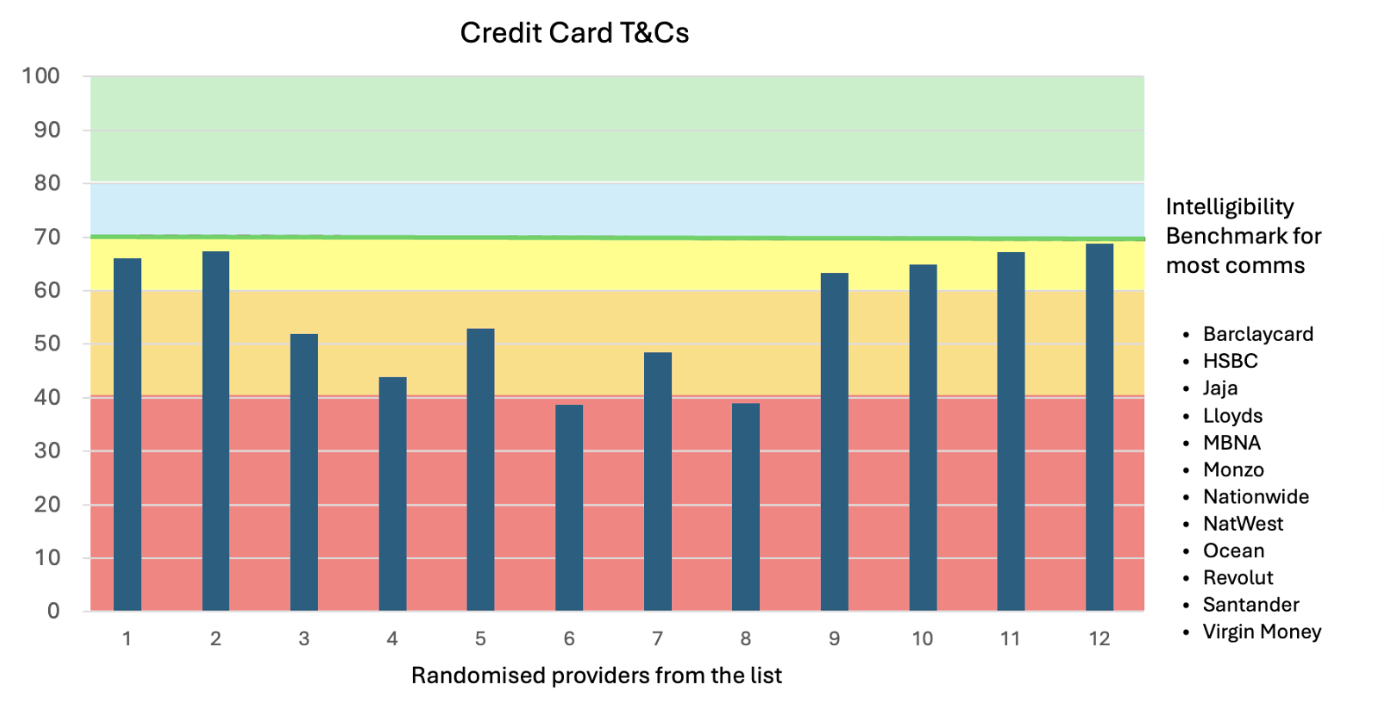

To illustrate the current challenge, we recently analysed several live credit card agreements from leading UK providers.

Each contained similar types of information, yet intelligibility scores varied widely:

- Best-performing documents scored in the high 60s on the Amplifi Intelligibility Scale. While we typically use 70 as a benchmark for acceptable clarity, these were approaching that threshold. These should be understandable to three-quarters or more of adults - good, but with room for improvement.

- The lowest scorers came in below 40, meaning they’re likely to be fully understood by just 30–40% of the adult population.

This shows how far the industry still has to go, even under the current regime. The risk is clear: unless intelligibility is assessed and improved at source, poor consumer outcomes will persist.

Clarity Must Stay at the Centre of Reform

The reform of the Consumer Credit Act presents an incredible opportunity to reshape disclosure regulation. But without:

- A clearer definition of intelligibility

- Real expectations for testing and reporting

- Clear and visible enforcement measures

…the industry risks replacing complexity with ambiguity.

Our message is simple: modernising the rules for the digital age is essential, and long overdue. But the true measure of success will be how well consumers understand what they’re signing.

Side Note: Amplifi’s Regulatory Credibility

Amplified Global has received direct innovation support from the FCA since 2019. Our platform, Amplifi, was developed and tested through the FCA Innovation Hub, the Digital and Regulatory Sandboxes. The testing included simplified versions of both arrears notices and pre-contract information. We have also shared a range of research we’ve carried out with the FCA, exploring how real people struggle to engage with and understand credit agreements, and why. Our work has shaped best practices around intelligibility, risk flagging, and outcome reporting, and continues to inform the FCA’s regulatory approach.