Assess. Prioritise. Simplify. Test. Track.

Clarity you can prove. Compliance you can track.

.png?width=50&height=50&name=2%20(1).png)

Sign up for a 7 day free trial of Amplifi.

Get full access and unlimited usage of the Amplifi platform for 7 days.

Where our clients come from

Amplifi core sectors

Financial Services

Meet Consumer Duty with confidence. Test, score, and improve regulated communications to minimise compliance risk and deliver better outcomes for customers - at scale.

Legal Sector

Make your legal content consumer-ready. From regulated disclosures and consumer notices to contracts, Amplifi helps ensure legal communications are clear, auditable, and aligned with key legislation.

Gambling & Gaming

Clarity isn’t optional — it’s mandatory. Help players understand key risks and make informed choices. Amplifi identifies high-risk communications and helps you simplify responsibly.

Regulators

Support and shape industry best practices. Amplifi’s partnership with regulators drives transparency, builds smarter content standards, and improves outcomes for all consumers.

Where innovation meets regulation

Built with support from the FCA

Amplifi has been supported by the FCA since 2019 through the Innovation Hub, Digital Sandbox, and Regulatory Sandbox — helping firms align with Consumer Duty expectations through tested, empirical research-backed tools.

The Regulatory need

Why Intelligibility Matters.

When your documents aren’t clearly understood, your customers can’t make informed decisions, and your business carries the risk.

Intelligibility goes beyond grammar or readability. It’s about ensuring the average consumer can grasp the meaning, consequences, and context of your communications, especially when it comes to regulated products and services. Poorly understood content can lead to:

- Regulatory breaches

- Customer harm and poor outcomes

- Reputational risk

- Increased complaints

- Missed internal performance targets

That’s why regulators like the FCA now expect firms to test their communications and track their impact on consumer behaviour, not just assume understanding.

Simply asking a consumer to confirm that they have understood something… is unlikely to be enough.”

— FCA Consumer Duty Guidance

How Amplifi helps

We're built inline with Regulation

Amplifi was built to solve this challenge, giving you the tools to assess, score, and evidence clarity at scale. So you can focus on delivering communications that not only tick boxes, but actually work.

Product Overview

Everything your team needs to assess, improve, and govern communications.

- Assess your comms at scale

- Identify areas of risk

- Simplify using AI writing tools

- Track improvements over time

- Create Regulatory reports

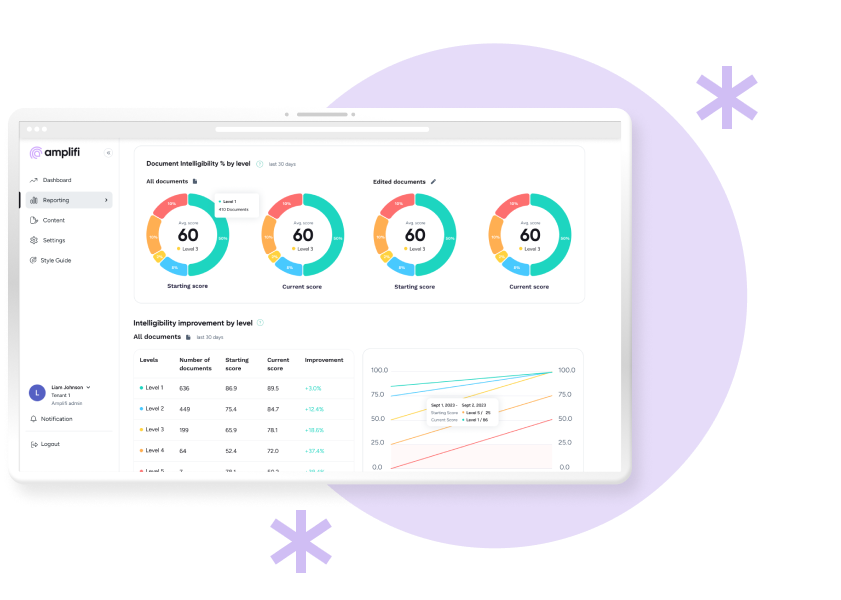

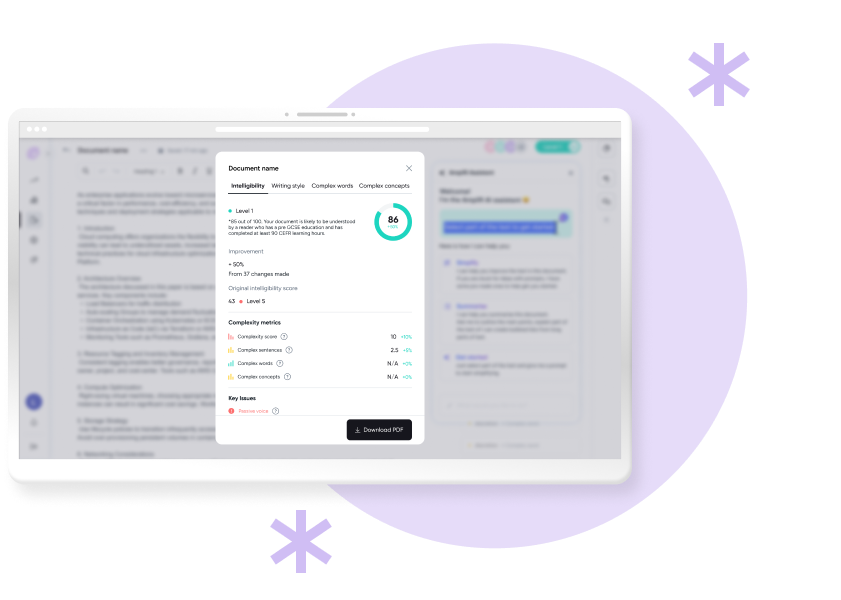

Score content objectively

Automatically assess communications using the proprietary Amplifi Intelligibility Score, built from regulatory research and behavioural insights.

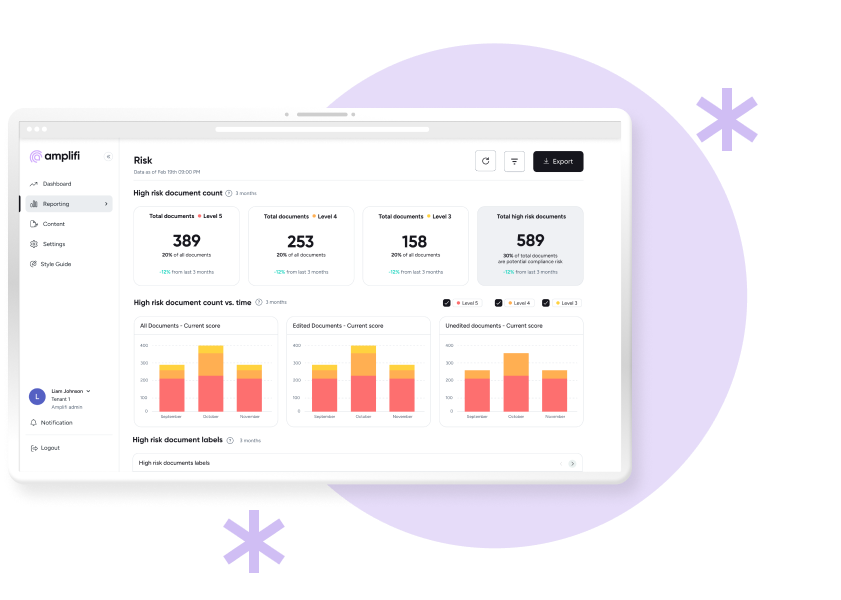

Prioritise at scale

Instantly analyse thousands of documents to identify high-risk communications so your team can focus on what matters most..

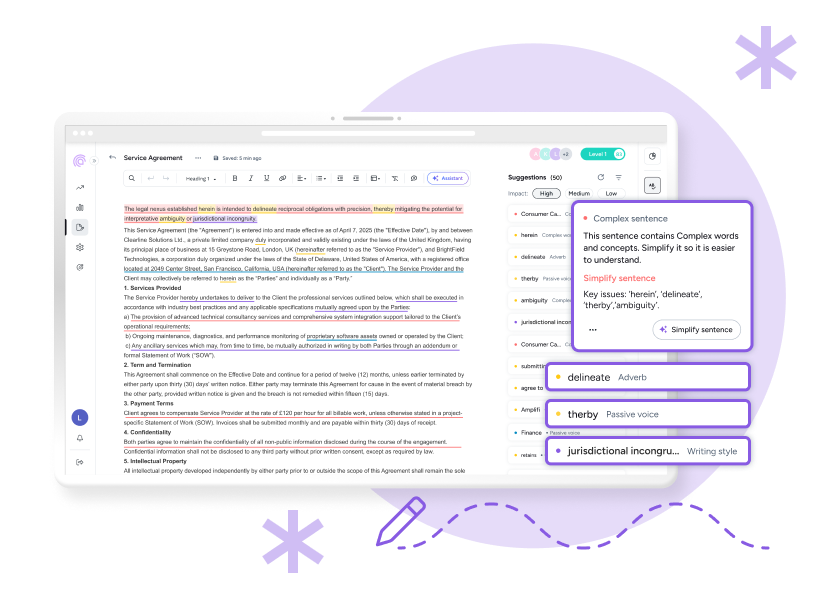

Simplify with confidence

Reduce compliance risk by simplifying your communications using our guided suggestions and real-time feedback.

Benchmark and improve over time

Track performance by document type, team, or business unit. Set targets and measure real improvements.

Automatically assess communications using the proprietary Amplifi Intelligibility Score, built from empirical academic research and behavioural insights.

Automate audits and reporting

Generate FCA-friendly reports with full audit trails, evidence of improvement, and actionable insights.

AI Marketplace

FCA AI Spotlight

The FCA AI Spotlight facilitates engagement between Firms and innovators for PoCs, Pilots and further information.

Innovative applications that deliver clear, understandable, and transparent decision- making processes in ways that are accessible for both consumers and wider stakeholders.

NextGen Legal Contract

Pioneering dynamic, layered contracts for consumers and SMEs.

A research-backed, patent-pending user journey that increases consumer engagement with legal contracts and helps firms track understanding and improve content.

Stay tuned for updates!

Up skilling and empowering

Amplifi Intelligibility Academy

We'll be soon launching two bold initiatives to shift the power balance in legal contracts:

Intelligibility Academy – Empowering firms to understand legal and regulatory obligations with best practices to creating clearer and more responsible communication.

Consumer Knowledge Centre – Putting consumers at the heart of the conversation by breaking down legal jargon, spotlighting rights, and enabling feedback on real terms and conditions via a review site.

Stay tuned for updates!

Don't just take our word for it.

Client Outcomes

Reduced complexity

33% fewer complex words and sentences

Reduced risk

30% reduction in risk levels across complex documents

Better clarity

11% improvement in overall communication clarity

Happy customers

6-point increase in customer satisfaction.

More Recommendations