Integrating Amplifi into your workflow

Read Time 3 mins | Written by: Ewan Willars

This article explores the various roles that Amplifi can play as part of an integrated workflow.

We’ll map the various aspects of Amplifi against a typical content creation and governance process, from content creation, to review and sign-off, and for both internal as well as external reporting.

Assessing content and consumer understanding risk

By uploading and testing a wide range of documents, clients can assess how intelligible they are.

Using labelling to identify different products, document types or business areas clients can then triage which types or categories of documents are most complex. This helps to identify where most work needs to be done, and the highest priority documents to be simplified.

Looking at the labelled documents that have the lowest average score will give you a general view of the risk they have of customers not understanding them. It will also tell you the root causes – whether high proportion of complex words and sentences, or readability issues and writing style.

At a document level this is also true. Individual low-scoring document can be identified and prioritised for simplification. This approach is particularly useful when combined with your other risk factors – such as risk based on the type of product, or a particular group of consumers.

Building Amplifi into your workflow

Content creation

We have a whole article on how to simplify documents and how best to use the tools available. Just be aware that, particularly for long documents, simplifying them can take time! Amplifi will make this a faster and more certain process, but it is not a silver bullet. Simplifying documents needs time and attention to do it right.

Ultimately, AI-based approaches like Amplifi work best when combined with the skills of a subject matter expert.

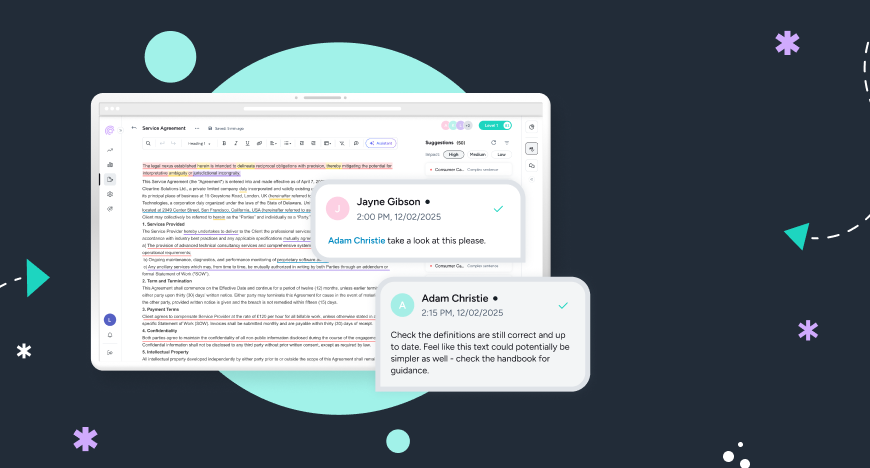

Content governance

The Amplifi Intelligibility Score is used by clients to set their own internal intelligibility benchmarks. Where we have seen Amplifi used to greatest value, it often involves clients building the Amplifi score and the level of intelligibility they are comfortable with into their content review and sign-off process.

This helps reviewers to test how intelligible the document is and consider this alongside other potential risk factors. Many clients have a soft or hard cut-off point for the intelligibility score which they expect content creators to match or exceed. This helps to ensure compliance with the consumer understanding outcome.

Where this is not possible, for example in very heavily regulated documents with lots of complex terms that can't be avoided, it allows the business to consider when other mitigations might be needed. This is essential to ensure that consumer understanding risk is managed effectively.

Reporting with Amplifi

Internal reporting

Our deep range of metrics and configurable reports mean that you can report within your organisation at any level. Whether at a team management or senior leadership level, or for audit and risk committees and the Board, the tool provides a detailed audit trail to keep track of your performance.

Reports can easily be automated and standardised, and can be configured in a wide variety of ways, depending on what you need.

External Reporting

Our scoring and the reports we provide have already been used by a number of our clients to report back to the FCA.

We provide objective insights into how firms are meeting their consumer duty obligations, both to test and simplify their content, and the governance and controls they have developed. As such we form a major part of many organisations compliance approach, and a key risk mitigation.

Regulatory compliance and consumer understanding is also increasingly used as part of ESG reporting by financial service firms to shareholders and other stakeholders.

Summary

To summarise how Amplifi fits into your workflow:1) Upload content to gain an overview of the intelligibility of your content, to prioritise your areas for action, and understand your compliance risk

2) Build Amplifi into your review and sign-off processes, and use us to set your internal standard or benchmarks

3) Use our reporting and analysis suite to provide data at various levels inside your organisation, and externally to report to the FCA